On April 10, 2024, the Bank of Canada kept interest rates unchanged.

On April 10, 2024, the Bank of Canada kept interest rates unchanged.

The Bank of Canada confirmed on April 10th that they will keep interest rates stable at 5.00%.

This decision aligns with Perch's forecast, which anticipated no change in interest rates due to sluggish inflation and a stretched economy.

The current overnight rate remains at 5.00%.

Key Points to Remember:

-The Bank of Canada has decided to maintain its policy interest rate at 5.00% in the most recent announcement.

-The upcoming interest rate announcement is scheduled for Wednesday, June 5, 2024.

-Perch's April mortgage forecast indicates that fixed rates are expected to decrease, while variable rates are anticipated to remain unchanged. To comprehend how this announcement may affect your mortgage payment or impending renewal, seek advice from a knowledgeable mortgage advisor.

Reasons Behind the Bank of Canada's Decision to Maintain Interest Rates Insights from Alex Leduc, CEO and Principal Mortgage Broker at Perch:

During the latest Bank of Canada interest rate announcement on April 10th, it was noted that while inflation is moving in a favorable direction, it has not yet reached the desired lower levels. Market expectations suggest that inflation will persist in its downward trajectory, with the anticipation of an initial rate cut in June to align inflation within the target range and prevent it from falling below the set target levels.

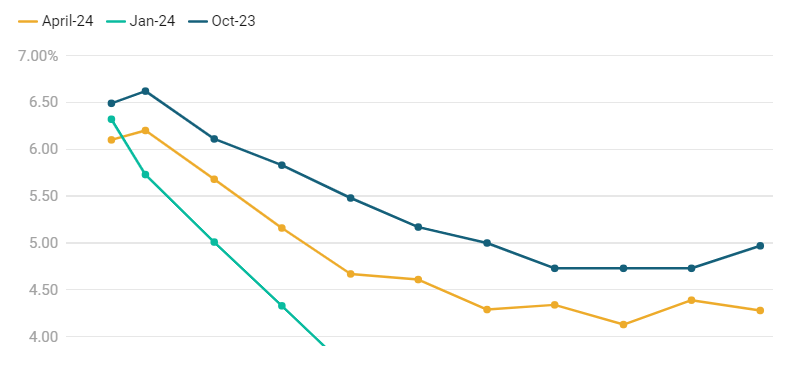

The chart below illustrates the evolution of Perch's 5-year variable rate projection over time, influenced by the Bank of Canada's interest rate updates. (Interested in receiving more personalized mortgage insights and our monthly mortgage outlook? Let us know and we can connect you with a representative at Perch to learn more!)

Canada's Variable Rate Forecast 2024-2029

A look at how our 5-year variable rate forecast has changed over time. Need expert mortgage advice?

The Bank of Canada's current priority is to realign inflation with the targeted 2%. It is expected that the Bank of Canada will start reducing rates from late 2024 to the end of 2026, which may lead to lower payments for adjustable rate mortgage holders in the upcoming years.

Additionally, the decision to purchase now presents an opportunity to secure a lower purchase price in today's market, ultimately benefiting you in the long term. To put it simply, while your mortgage payment may vary with changes in terms, your purchase price remains constant.

There is a growing trend among new buyers to select a shorter mortgage term with a longer amortization period to minimize their monthly payments. This approach allows for the potential to refinance at a lower rate in a few years and ultimately speed up the mortgage repayment process.

How will the most recent Bank of Canada interest rate announcement impact housing prices?

In April, it is foreseen that fixed rates will continue to decline while variable rates will remain unchanged. The national sales activity saw a 3.1% drop in February, following a 12.4% increase since December. Despite this, February sales still lagged behind the 10-year average by 5%. On a year-over-year basis, sales activity in February 2024 rose by 19.7% compared to the dismal February data observed over the past two decades.

Canada's inventory rose by a marginal 1.6%, far from the levels witnessed in mid-2023. Consequently, the sales-to-new listings ratio slipped to 56.6% in February, down from 58.8% in January – a considerable drop from its peak of 67.9% in April 2023. As per CREA, a ratio ranging from 45% to 65% is typically indicative of a stable housing market. Shaun Cathcart, CREA's Senior Economist, noted that February could be the last relatively uneventful month in terms of the 2024 housing market dynamics, with the focus shifting towards the number of homes put up for sale this year.

Despite remaining flat on a month-over-month basis in February, the Aggregate Composite MLS Home Price Index experienced a 0.8% uptick year-over-year. The actual national average home price in February stood at $685,809, reflecting a 3.5% annual increase.

Anticipated Mortgage Rate Trends for 2024: Based on financial forecasts by Alex Leduc, Principal Broker at Perch, it is predicted that 5-year variable mortgage rates will commence a decline in late 2024.

Future Mortgage Rate Projections: The latest Mortgage Rate Outlook suggests that 5-year variable mortgage rates are likely to decrease in 2024 and extend further into 2025. Periodic updates to the mortgage rate forecast will follow every Bank of Canada interest rate announcement – interested individuals can enroll for the mortgage rate forecast program at no cost.

What is the current Bank of Canada interest rate?

The prevailing Bank of Canada interest rate is 5.00%, following a 0.25% increase announced on July 12, 2023.

When is the upcoming Bank of Canada interest rate announcement? The upcoming Bank of Canada interest rate announcement is scheduled for Wednesday, June 5th, 2024, at 9:45 AM ET.

What are the interest rate announcement dates for 2024? There are a total of 8 Bank of Canada interest rate announcements conducted annually. The dates for 2024 are outlined as follows:

Wednesday, January 24, 2024 Wednesday, March 6, 2024 Wednesday, April 10, 2024 Wednesday, June 5, 2024 Wednesday, July 24, 2024 Wednesday, September 4, 2024 Wednesday, October 23, 2024 Wednesday, December 11, 2024 (Source: Bank of Canada)

Typically, the Bank of Canada issues its interest rate announcement at 9:45 AM Eastern Time.

If you would like to take a peek at what your rates would look like and to get some more information on how to secure a mortgage visit the link below:

https://app.myperch.io/auth/sign-up?utm_source=blog&utm_medium=banner&utm_term=BOC_announcement

Categories

Recent Posts